Economic debates about demographic change have tended to focus on the effects of growth – whether it’s Malthusian concerns over the burden of feeding a larger population, or how the carbon emissions created by larger populations amplify the impact of climate change. However, many of the world’s largest economies are now entering an unprecedented period of demographic stagnation and even population decline.

This phenomenon is perhaps most acute in Europe, where the continent’s population began to shrink in 2020. According to estimates from the UN Population Division, by 2030 they’ll be almost 10 million fewer Europeans than there were at the start of the decade. Germany’s population may decline by around half a million people over the same period, while Italy’s could shrink by almost two million.

Elsewhere, Japan’s population, which peaked in 2009, is forecast to fall by more than 5 million people before the end of the decade. China’s population may have already peaked last year.

The United States, something of a demographic outlier among developed economies, will see its population continue to grow through to the end of the century. However, it’s rate of growth is slowing – in 2030, the United States will be home to around 16 million more Americans than it was in 2020, compared with the 25 million the country added in the previous decade.

Between now and the middle of the century, just five countries will account for around 43% of the world’s population growth: India, Nigeria, Pakistan, the Democratic Republic of Congo and Ethiopia.

How economies change as they age

Shrinking populations, or even slowing growth, should be a cause of concern for businesses and policymakers. Economic growth is, in large part, simply a function of more people in work and rising levels of output per worker. From 1960 to 1990, when the global population grew at an average rate 2% a year, annual GDP growth averaged more than 4% a year. Since then, population growth has almost halved and global economic growth has slumped to an average rate of less than 3% a year.

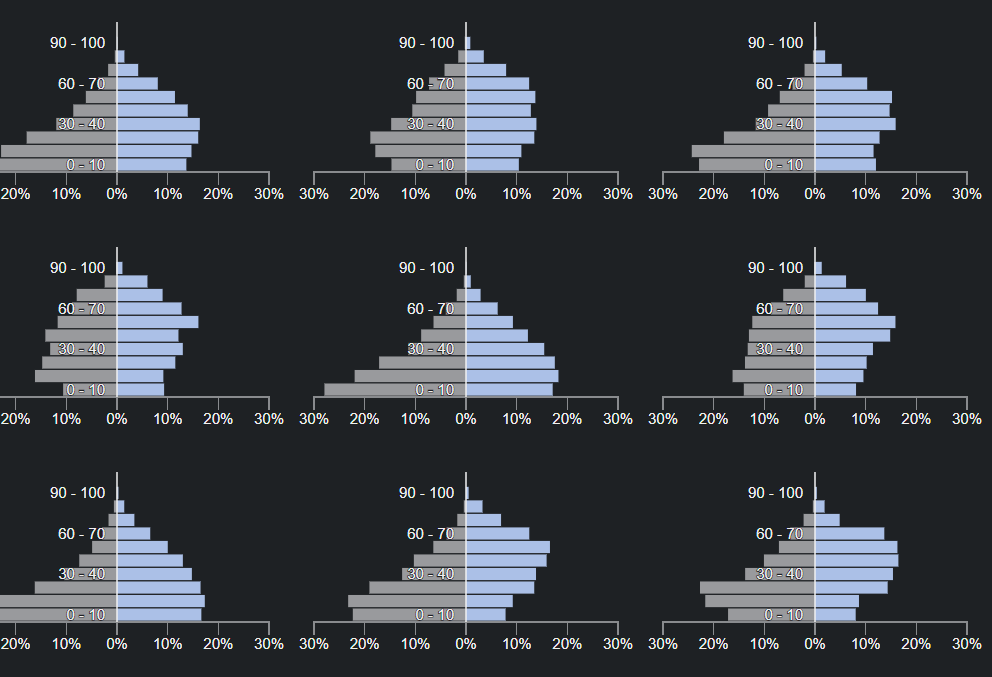

Moreover, while life expectancy has risen over the last few decades, retirement ages have tended to remain around the mid-60s. Combined with falling fertility rates, this has left many economies with a surging stock of retirees and a dwindling supply of working age people (those aged between 15 and 64).

Over the next two decades, we are on course to see major shifts in the size of the workforce: China and Germany will see around an eighth of their workers retire, while South Korea and Italy will experience declines of 24% and 21% respectively. Japan will similarly lose around 18% of its workers. The United States and Britain, in contrast, will still see increases – albeit paltry ones – with the working age population rising by 3% and 1% respectively between 2020 and 2040.

It’s relatively uncontroversial among economists that the dwindling supply of workers, in the absence of significant rises in productivity, will limit the prospects for economic growth. However, there is considerable debate about the effects of ageing on inflation.

It’s often supposed, based on the experience of Japan, that growing ranks of retirees pushes down the rate of inflation. This is because those in work spend more than those too old (or indeed too young) to work – so as the proportion of working age people declines, demand and prices fall too.

Recent analysis by economists Charles Goodhart and Manoj Pradhan however, has called this line of argument into question. Those in the workforce, they point out, produce more than they consume themselves – if they didn’t, there wouldn’t be anything for non-workers to consume. As workers retire, demand may well decrease, but supply will decrease more. This reduction in supply, according to Goodhart and Pradhan, will in fact push inflation up. The jury is out on which effect will dominate.

Moreover, a shortage of workers is likely to drive policymakers to seek to bring in new supplies of labour. They may tolerate higher levels of immigration, or pursue initiatives to increase birth rates or boost labour participation among groups such as women, where it has traditionally been lower.

The property life cycle

Population is perhaps the most fundamental determinate of demand for different types of property. As economies age and workforces shrink, how will demand and investment opportunities across the real estate sector change?

Demand for office space will be impacted not only by the dwindling supply of workers, but also because many of the jobs created in an ageing economy will be in non-office sectors such as health and social care, and life sciences. Indeed, these demographic “growth areas” have already spurred considerable investment into alternative sectors such as retirement living, healthcare and pharmaceutical laboratories.

At the same time, the competition for workers will intensify among firms, which may lead them to be more selective about the countries and cities they invest in – perhaps shifting more of their operations to those locations which offer a considerable pipeline of future talent. This will create opportunities, and perhaps buoyant office markets, for young economies like India and South Africa.

Acute labour shortages are already impacting the industrial and logistics sector, and these will only intensify as populations age. This could possibly spur greater adoption of robots and other autonomous machines inside warehouses and factories, which in turn will impact how these sorts of facilities are designed, operated and powered.

The residential sector is likely to prove somewhat resilient to slowing or even negative population growth, due to both the longstanding undersupply of housing and because many older people will opt to continue living in their existing family houses. This will mean there will continue to be demand for new housing stock in aggregate, but that much of the existing stock may be occupied inefficiently. We’re also likely to see relative demand for smaller households rise, both because young workers are opting to delay having families until later in life and because of falling fertility rates.

Unlike many phenomena in economics, demographic trends are indisputably of profound importance and relatively easy to forecast. This should prompt decision-makers at both occupiers and investors to start reckoning with the effects of ageing now.